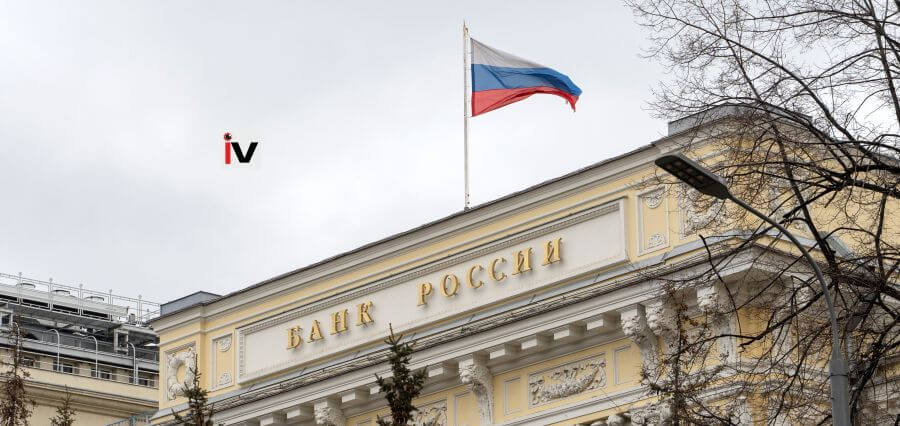

Russia’s central bank said on Friday it had raised its key interest rate 200 basis points to 21%. The rate hike follows consumer prices being higher than expected and there are still risks of medium-term inflation.

The central bank had already lifted the benchmark rate 100 basis points to 19 percent in September. The hike now is higher than that projected by analysts of an increase of 100 basis points and represents the largest benchmark rate since February 2003. It peaked at similar levels in February 2022 when raised to 20 percent to address a selloff from local markets following the break-out of the Ukraine war.

During a post-decision briefing, Central Bank Governor Elvira Nabiullina seemed to carry the hawkish tone and informed that the board has given due consideration to hiking even more than 21%. She didn’t close out the window of possibility during the next scheduled meeting due in December as she commented, as reported by the state news agency of Russia Tass.

The central bank said inflation, seasonally adjusted over a year, was still at an average of 9.8% in September, from 7.5% in August. It now projects it will stabilize at between 8.0% and 8.5% by the end of this year, much higher than the previous estimate of 6.5% to 7.0%. Based on the statement, the inflation by the bank was high at upside risks due to perpetuating high inflation expectations. The Russian economy has become deviated from a growth path balanced. Foreign trade conditions are deteriorating added to these risks. However, the central bank said that annual inflation is predicted to ease to 4.5% to 5.0% next year and to 4.0% in 2026.

The Russian economy is still under pressure from low global prices for its key oil exports and Western sanctions. These sanctions have cut trade and sent the ruble plummeting. As of 12:52 p.m. London time, the U.S. dollar was up 0.36% against the ruble.

Such growth in rates during a time of monetary policy relaxation by Europe and the US may hinder Russia’s prospects for expansion. The IMF expects this year’s Russian inflation will average 7.9%. GDP should slow to 1.3 percent by 2025 compared with 3.6 percent in 2023, mainly reflecting a slow-down in private consumption and investment in a tightening labor market and moderating growth in wages.

1 comment

Pretty! This waas a really wonderful article. Thanks for supplying these details. https://w4i9o.mssg.me/